does florida have capital gains tax on stocks

Floridas capital gains tax rate depends upon your specific situation and defaults to federal rules. Income over 40400 single80800 married.

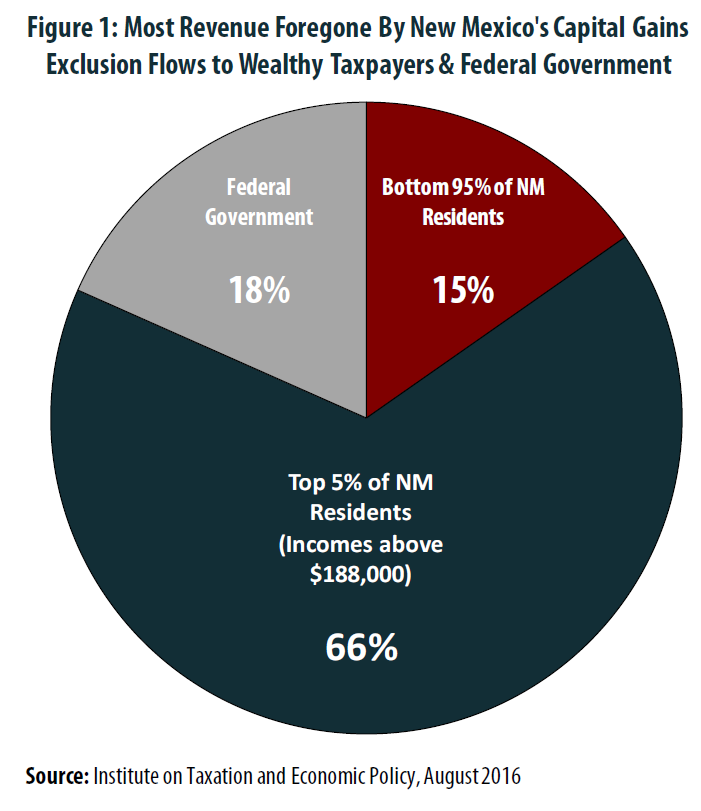

The Folly Of State Capital Gains Tax Cuts Itep

If i sell 2 million in stock i have.

. Section 22013 Florida Statutes. You likely dont have to personally file in Florida. The State of Florida does not have an income tax for individuals and therefore no capital gains tax for individuals.

You have lived in the home as your principal residence for two out of the last five years. Florida has no state income tax which means there is also no capital gains tax at the state level. Click to see full answer.

After federal capital gains taxes are reported through IRS Form 1040 state taxes may also be applicable. Does Florida have a capital gains tax. These come in the form of capital gains taxes.

Regarding this what is the capital gains tax rate in Florida. Florida Department of Revenue. Does florida have capital gains tax on cryptocurrency.

The State of Florida doesnot havean income taxfor individuals and therefore no capital gains taxfor individuals. If you have a net capital loss you can deduct up to 3000 from your gross income he said. You can maximize this advantage by frequently moving homes.

The American Taxpayer Relief Act of 2012 instituted a long-term capital gains tax rate for taxpayers of up to 20. The state sales tax rate is 6 percent on all purchases except for food and medication. Long-term gains are profits on assets held longer than 12 months before they are sold by the investor.

Youll have a capital gain of 5000. The short answer is No assuming we are talking about a true day trader. If youre in the 22 tax bracket thats the rate that will apply to the short-term capital gain.

Since 1997 up to 250000 in capital gains 500000 for a married couple on the sale of a home are exempt from taxation if you meet the following criteria. Ncome up to 40400 single80800 married. Special Real Estate Exemptions for Capital Gains.

If you earn money from investments youll still be subject to the federal capital gains tax. Florida doesnt have that distinction. States That Dont Tax Capital Gains.

Again this varies based on whether the money comes from short-. This is because these nine states do not have an income tax. Take advantage of primary residence exclusion.

Since the gain is considered short-term it will be taxed at your regular income tax rate. No capital gains tax in New Hampshire. The State of Florida does not have a personal income tax on individuals so there would be no state tax imposed on any of his earnings from day trading.

The good news is florida does not have a separate state inheritance tax. Long term and short term. The capital gains tax calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property.

Short-term gains on assets held for 12 months or less are. The Florida income tax code piggybacks the federal income tax code for treatment of capital gains of corporations. Income over 445850501600 married.

The capital gains tax is based on that profit. In addition to federal capital gains tax rates you may also be exposed to state capital gains tax. The two year residency test need not be.

If you are in the 25 28 33 or 35 bracket your long-term capital gains rateis 15. Each is subject to different tax rates. Answer 1 of 3.

Your primary residence can help you to reduce the capital gains tax that you will be subject to. Capital gains are the profits you make when you sell a stock real estate or other taxable asset that increased in value while you owned it. Additionally the states property tax rate is 789 mils or 798 per 1000 in value of the property being assessed.

You do not have to pay capital gains tax until youve sold your investment. There are two types of capital gains. Capital Gains Tax Rate.

Nevada Department of Taxation. Florida has no state income tax which means there is also no capital gains tax at the state level. Nevada does NOT have a capital gains tax similar to federal income tax New Hampshire Department of Revenue Administration.

Rule 12C-1013 Florida Administrative Code. Includes short and long-term Federal and State Capital Gains Tax Rates for 2021 or 2022. The easiest way to lower your capital gains taxes is simply to own the asset whether real estate or stocks for at least a year.

If you earn money from investments youll still be subject to. Specifically New Hampshire imposes a 5 tax on dividends and interest while Tennessee charges a 6 tax on investment income in excess of 1250 per person. There is currently no Florida income tax for individuals and therefore no Florida capital gains tax for individuals.

The following states do not tax capital gains. While Florida doesnt tax the earnings of its citizens it collects revenue from individuals using two other forms of taxation. The long-term capital gains tax rate is typically 0 15 or 20 depending on your tax bracket.

Calculate the capital gains tax on a sale of real estate property equipment stock mutual fund or bonds. In this case the tax liability will be 1100 5000 times 22. 52 rows The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property.

Individuals and families must pay the following capital gains taxes. The amount that can be excluded stands at 250000 for an individual and 500000 for a married couple.

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

Capital Gains Tax Calculator 2022 Casaplorer

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Capital Gains Tax What Is It When Do You Pay It

The States With The Highest Capital Gains Tax Rates The Motley Fool

Capital Gains Tax Definition Rates Calculation

Capital Gains Tax Rate 2022 How Much Is It Gobankingrates

How To Pay 0 Tax On Capital Gains Income Greenbush Financial Group

How High Are Capital Gains Taxes In Your State Tax Foundation

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Income Types Not Subject To Social Security Tax Earn More Efficiently

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

What Is Capital Gains Tax The Motley Fool

Understanding Capital Gains Taxes For Fiscal 2021 What You Need To Know